4800 Meadows Rd

Suite 300

Lake Oswego, OR 97035

Ph: 541.658.2469

Challenges Specific to Senior Housing

After 25 years of watching operators expand, I can predict your claims before you file them

I need to tell you something that's going to make you uncomfortable: Every time you choose growth over grace, you're not just compromising care, you're creating insurance catastrophes I'll be cleaning up for the next five years.

I've seen this movie too many times. Operator gets aggressive about expansion. Rushes hires. Cuts corners on training. Dilutes culture in senior living facilities. Then calls me eighteen months later when their loss ratios are destroying their renewals and their GL carrier is threatening non-renewal.

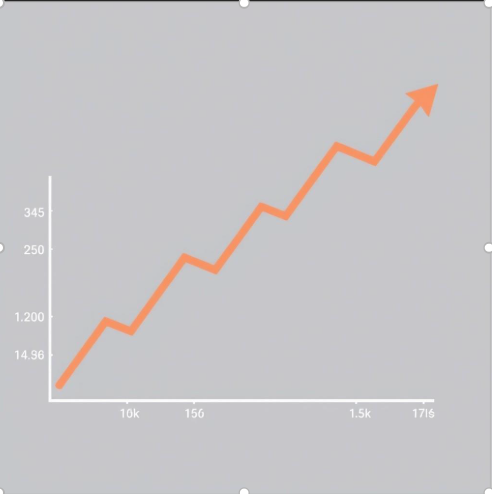

The math is brutal and predictable: When your growth curve rises faster than your grace curve, your claims curve explodes right behind it.

Here's what haunts me: I can walk through your community and predict your insurance future with terrifying accuracy. Not by looking at your policies or procedures, but by watching how your staff interact with residents for thirty minutes.

Risk Exposure and Management Strategies

The Terrible Arithmetic of Rushed Growth

When I analyze claims data across my book of business, the pattern is unmistakable. The operators with the worst loss experience aren't the small struggling ones, they're the fast-growing "successful" ones.

Why? Because proactive strategies lead to sustainable growth and reduced risk. Because they made a fatal calculation error. They thought they could scale systems without scaling soul. Multiply beds without multiplying bonds. Expand operations without expanding empathy, and you'll face increased liability claims.

But insurance doesn't lie. Claims data tells the real story of what happens when people feel like numbers instead of neighbors.

Every slip and fall claim. Every medication error. Every family complaint that turns into a lawsuit. Every workers comp claim from burned-out staff can increase insurance coverage costs. These aren't random accidents, they're predictable outcomes of growth without grace.

What are the threats causing facilities to face liability exposures and higher costs of coverage?

The Three Insurance Catastrophes I See Every Year

Here's what expansion-obsessed operators don't realize: When residents feel invisible, they become unpredictable.

I've seen the claims. Mr. Johnson wanders at 2 AM in assisted living because nobody remembered he used to be a night-shift security guard who feels restless when everyone else sleeps. Mrs. Patterson refuses her medications because the new staff doesn't know she needs to feel in control of something, anything, after a lifetime of independence.

These aren't care failures, they're recognition failures. And recognition failures turn into insurance nightmares.

The operators who maintain sub-1.0 loss ratios during growth? They've figured out how to make every resident feel seen, known, and valued. Not through systems, through souls.

Fast-growing operators think turnover is just a staffing problem. It's actually an insurance time bomb.

Here's the loop I see constantly: Rapid expansion leads to staff stretched thin which means residents feel neglected so families complain which makes staff feel blamed so good staff leave which means remaining staff get more stretched so quality drops and claims spike and insurance costs explode.

But the operators in senior housing who grow gracefully? They break this loop before it starts. They understand that every great caregiver they retain prevents ten claims they'll never have to file.

This is the most expensive mistake I see: Operators who think they can hire faster than they can train, expand faster than they can integrate, grow faster than their culture can absorb.

The result? Cultural chaos that shows up in my claims reports as "unexplained" incident spikes.

When your 15-year veteran aide doesn't recognize the values of your newest hire, when your night shift operates by different principles than your day shift, when your satellite communities feel like different companies, that's not growth, that's fragmentation. And fragmentation is uninsurable.

Proactive Strategies for Senior Living Owners and Operators

The Grace Multiplication Solution is a proactive strategy for senior living operators to enhance their services.

But here's what keeps me fighting for this industry: I've seen operators crack the code on graceful growth. And their insurance performance proves it's possible.

These aren't the biggest or best-funded operators. They're the ones who discovered something revolutionary: Grace doesn't diminish with scale; it deepens.

How? They made three breakthrough discoveries:

The operators with the best loss experience don't try to manage their way to bigger; they develop love-multipliers who proactively mitigate risks. They love their way to bigger.

They don't hire managers; they develop love-multipliers who enhance risk management. People who can see a resident the way the founder would see them. Feel what the founder would feel. Care like the founder would care.

When love scales, claims plummet. Because love prevents incidents in senior living that management can only react to.

Traditional operators scale through standardization. Graceful operators scale through stories.

They don't train, they tell stories about the time Mrs. Chen smiled for the first time in months when someone remembered she needed her pills with orange juice, just like her husband used to bring her.

Stories carry grace across communities. Procedures carry compliance across departments. Guess which one in senior housing prevents claims?

Small operators think they maintain quality through proximity, knowing every resident personally. But proximity doesn't scale. Intention does.

The best growing operators in senior living teach their teams to be intentional about seeing people. To look for the person behind the diagnosis. To find the spark that makes each resident irreplaceable.

And intentional love is more powerful than accidental love.

Improve Quality of Care and Your Bottom Line

The Sacred Mathematics That Change Everything

Here's the equation that separates my lowest-risk clients in the insurance market from my highest-risk ones.

For every new bed you add, you must multiply your capacity to make someone feel irreplaceable, or you multiply your exposure to claims that could destroy you.

The operators who understand this don't just manage risk, they eliminate it at the source:

Staffing Adequately Will Pay Off in the Long Run

The Promise That Transforms Everything for senior living operators is the ability to mitigate risks effectively.

After 25 years in this business, I've learned to spot the senior living operators who'll succeed at scale and the ones who'll implode trying to manage their risk.

The difference isn't in their business plans or their capital structures, but in their approach to risk management. It's in how they answer one question: Are you growing to serve more families, or are you serving families to justify growth?

Because here's what I know for certain: When you choose grace over growth in senior living, growth follows grace. When you choose growth over grace, chaos follows both.

Every family who walks through your doors is conducting an experiment: Will their loved one be seen, valued, and cherished in your care?

Honor that experiment, and it will help you build an empire. Betray it, and no insurance policy in the world can protect you from the consequences.

The choice is yours: embrace proactive strategies or risk burnout. But the claims data doesn't lie.

Choose grace and proactive measures to enhance your operations. Your future self and your insurance premiums will thank you.